8+ Years

Experience in Blockchain

80%

Blockchain Expert

450+

Project Completed

150+

Client Worldwide

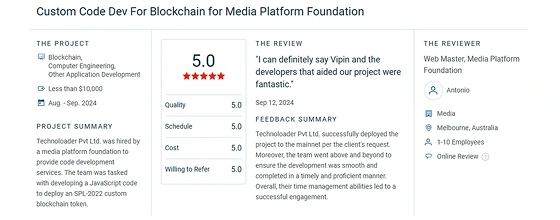

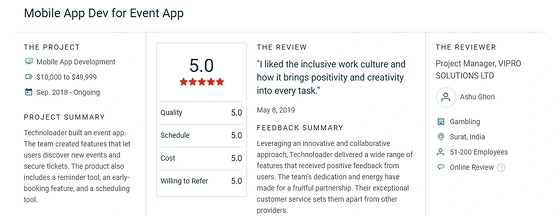

Top Cryptocurrency Exchange Software Development Company

Technoloader is a leading provider of crypto exchange development services. We specialize in advanced exchange development, including CEX, DEX, P2P, copy trading, crypto derivatives, and more.

No matter whether you are looking to launch from scratch or want to opt for white label exchange development to hit the market faster, we have the tools, tech, and team to make it happen. We prioritize security, scalability, and a smooth experience to meet all expectations of modern cryptopreneurs.

So, ready to turn your crypto business idea into a fully-functional trading platform? Let us help you bring your vision to life with top-notch features and end-to-end support!

Why You Should Invest In Cryptocurrency Exchange Development?

Market Size

Constant Growth Rate

Higher Transaction Efficiency

Rapid Market Expansion

The global crypto exchange market is valued at $24.75 bn in 2024 and is projected to reach $71.9 bn by 2029 (CAGR 23.8%).

Strong Funding

CoinDCX raised $247M+ & CoinSwitch raised $260M+, which signals strong investor confidence in crypto exchange across emerging markets.

Market Opportunity

A CAGR of 15–25% is expected from 2024 to 2030, which is driven by tokenization, DeFi, NFTs/metaverse, and regional expansion.

Types of Crypto Exchange Development

Partner with Technoloader to build feature-rich crypto exchange software that aligns with your business goals. We are proficient in developing all types of exchanges to ensure seamless, secure, and scalable trading experiences.

Centralized Exchange Development

Deliver a high-performance trading experience with our centralized crypto exchange development solutions. They offer fast order execution, robust security, and scalable architecture to support crypto transactions across global markets.

- • Advanced order-matching engine

- • Multi-tier security protocols

- • KYC/AML integration

- • High liquidity management

- • Fiat-to-crypto & Crypto to Fiat support

- • Admin dashboard and analytics

Decentralized Exchange Development

Our decentralized exchange development services offer users complete control over assets through smart contracts. We build secure, transparent, and trustless platforms that ensure enhanced privacy and censorship resistance.

- • Smart contract-driven trading

- • Non-custodial wallet integration

- • Liquidity pool management

- • No KYC

- • Cross-chain swap support

- • On-chain governance tools

P2P Exchange Development

We develop P2P exchange platforms that enable direct crypto transactions between users and exchanges. It benefits users with flexible trade terms that support localized trading with global accessibility and flexibility.

- • Escrow-powered transactions

- • Buyer/seller rating system

- • Multi-currency wallet support

- • Customizable trade terms

- • In-app messaging

- • Dispute management module

Hybrid Exchange Development

Experience the benefits of both centralized and decentralized systems by developing a hybrid crypto exchange. Our hybrid solutions support a wide range of trading activities with enhanced performance and user trust.

- • Centralized order book

- • On-chain/off-chain processing

- • Enhanced scalability

- • KYC compliance with privacy options

- • Asset custody flexibility

- • High-throughput engine

White-Label Crypto Exchange Development

Launch your own exchange quickly with our white-label crypto exchange development services. Our experts design it for seamless branding, fast deployment, and top-level security with full trading functionality.

- • Fast deployment

- • Custom branding

- • Modular architecture

- • Integrated wallets and APIs

- • Role-based access control

- • Pre-tested security modules

Copy Trading Exchange Development

Our copy trading exchange development solutions empower users to follow and replicate expert trading strategies. We build intuitive and automated exchanges ideal for beginners looking for passive income and informed trading decisions.

- • Leaderboard of top traders

- • Auto-copy trading system

- • Risk management tools

- • Transparent performance metrics

- • Trader subscription models

- • Analytics and reporting tools

Crypto Derivatives Exchange Development

We offer crypto derivatives exchange development solutions that support futures, options, and perpetual contracts. Our exchange includes high-speed engines, risk control tools, and smooth user interfaces for trading.

- • Support for futures, options, and perpetual swaps

- • Real-time risk and margin management system

- • High-speed matching and trading engine

- • Customizable leverage and contract types

- • Integrated funding rate and liquidation modules

- • Advanced charting and analytics tools

Our Cryptocurrency Exchange Development Services

As a leading service provider in the field, we can help you launch a crypto exchange that reflects your vision. Our solutions cover everything from core trading engines to advanced security, such that you scale fast and lead confidently in this space.

Custom Exchange Development

We build secure, scalable, and fully customized cryptocurrency exchange platforms through expert development processes tailored to your business model, trading features, and more.

Crypto Exchange Consulting

Our expert consultants can help you define a complete development roadmap, including strategy, compliance, features, and tech stack, to successfully plan, launch, and scale your cryptocurrency exchange.

White Label Exchange

Launch your branded crypto exchange quickly using our ready-to-deploy white-label solution. It includes built-in features and robust security to help you enter the market rapidly.

Crypto Payment Gateway

Enable fast and secure crypto transactions with our custom-built crypto payment gateways. It supports multiple currencies and wallets and seamless integration into websites, apps, or software.

Integration Services & Solutions

We offer seamless integration of third-party APIs, wallets, liquidity providers (Binance, Kraken), and blockchain networks to ensure smooth, secure, and scalable exchange functionality and operations.

Crypto Trading Bot

We build powerful automated trading bots that execute trades in real-time, maximize profits, minimize risks, and adapt to market changes for seamless and efficient trading experiences.

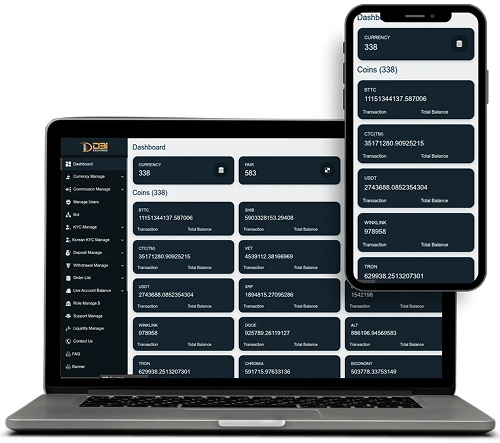

Advanced Features That Power a Seamless Crypto Exchange Development Experience

Our crypto exchange software is packed with features that enhance trading efficiency for users and includes a versatile admin panel to manage and maintain integrity effortlessly.

Our robust admin panel is designed through scalable backend development that gives you full control over your crypto exchange. This way, you can monitor performance, manage users, and analyze exchange operations in real time.

Manage Liquidity API

Trade Pairs Management

Monitor Transaction Record

Dispute Management

Unlimited Revenue Modules

Multi-purpose Dashboard

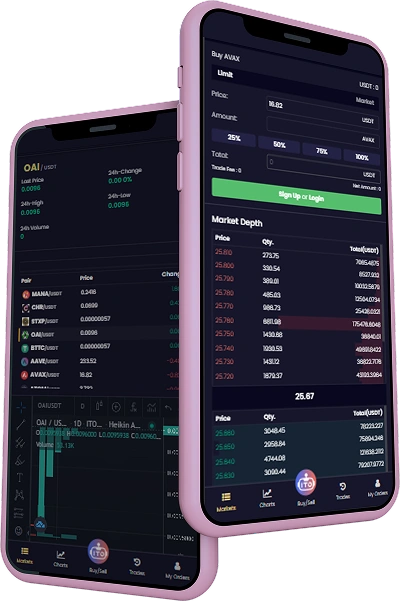

We integrate powerful trading features through robust and frontend development that can deliver a seamless user experience. From fast transactions to smart analytics, you can help your users trade confidently and easily.

Multi-chain Wallet

Multilingual Support

P2P/Spot/Derivative Trading

Transaction History & Order Book

Two-Factor Authentication

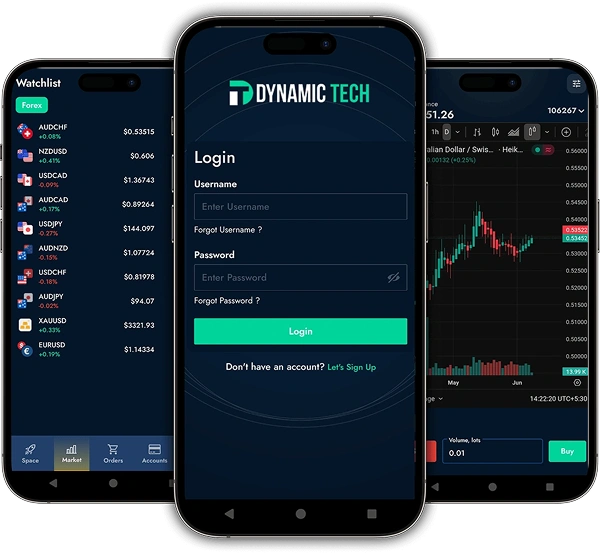

Mobile App Development

Advanced Chart Tools

Fiat/Crypto Payment Gateway

Customised User Panel/Interface

Built with top-level security, our software uses secure development protocols, advanced encryption, multi-layer protection, and real-time threat detection to protect user data and defend against cyber threats.

Automated KYC & AML

DDoS Mitigation

Biometric Authentication

Two-factor Authentication

Data Encryption

Anti-whale Feature

We offer a range of smart add-ons and plugins to enhance usability and performance. This can extend functionality and ensure a smooth and modern trading experience.

ICO/IEO/STO

Crypto Trading Bot

Staking, Swapping, and Lending

Crypto Price Ticker API

Versatile Payment Gateway

Merchant API

Benefits of Using Our Crypto Exchange Software Development Services

When you choose our crypto exchange development services, you gain a powerful set of advantages designed to benefit both entrepreneurs and end-users. Our solutions are built to drive success and deliver seamless trading experiences. Here are the key benefits:

Customizable Trading Software

We build exchanges that adapt to your business needs. From custom interface designs to third-party integrations, everything is fully customizable—ideal for startups and enterprises looking for tailored trading experiences without breaking the bank.

Quick Launch Capability

Our ready-to-deploy framework allows you to go live fast. With pre-built architecture and the ability to add custom features, you can hit the market quickly and stay ahead of the competition.

24x7 Accessibility

Our exchange operates round the clock, giving users uninterrupted access to global crypto markets. With real-time data and smooth transaction flow, users enjoy a reliable trading experience any time of day.

Cost-Effective Development

With years of experience, our team ensures efficient and high-quality development. We help you launch robust exchanges faster and at a lower cost—saving you both time and resources.

User-Friendly Interface

Designed for both beginners and professionals, our crypto exchange features an intuitive and easy-to-navigate UI/UX. Admins and traders can manage all functions smoothly with minimal training or guidance.

Flexible Revenue Streams

We offer multiple built-in monetization options so you can generate consistent income. Choose the revenue model that aligns best with your business strategy and investor goals.

Crypto Exchanges We've Built: Our Portfolio

At Technoloader, we take pride in using secure and scalable crypto exchange development frameworks. Our portfolio displays successful projects that we have meticulously crafted to ensure security, scalability, and a seamless trading experience for users worldwide. Have a look into each cryptocurrency exchange we’ve built!

Why Launching a Crypto Exchange Is a Smart Business Decision

Starting your own crypto exchange is a strategic move in today’s digital economy. With rising interest in secure and easy-to-use trading platforms, building a crypto exchange lets you tap into a high-growth, high-revenue industry.

The global crypto exchange market is forecasted to reach $260.17 billion by 2032, growing at an annual rate of 20.3%.

Centralized Exchanges (CEX) will continue dominating with an estimated 87.4% market share by 2025, thanks to higher liquidity and trust.

North America leads globally with 37.2% market share, driven by clear regulations and strong institutional interest.

Asia-Pacific is the fastest-growing market, projected to hold 23.8% share by 2025, fueled by crypto adoption and favorable policies.

From $45 billion in 2022, the market is expected to exceed $110 billion by 2028, signaling strong investor confidence and sustainable growth.

White Label Crypto Exchange Development

Our white-label solutions are built with flexible development modules that enable businesses to launch fully branded, feature-rich exchanges with speed and cost-efficiency. With our white-label solutions, you get a secure, scalable, and customizable exchange that’s pre-built for fast deployment.

Why Choose Our White-Label Crypto Exchange Solutions?

- Faster Time-to-Market – Go live in days, not months.

- Affordable Development – Suitable for startups and large enterprises alike.

- Fully Customizable – Modify UI/UX, features, integrations, and more.

- Multi-Currency Support – Trade and manage various cryptocurrencies with ease.

- High Liquidity & Security – Built for performance and trust.

We handle all the backend complexities so you can focus on growing your business and scaling your operations.

Revenue Models Integrated in Our Crypto Exchange Development

We integrate diverse revenue streams to help your crypto venture achieve long-term profitability. These revenue streams are baked into our exchange architecture and optimized for high returns:

Trading Fees

Trading Fees

Withdrawal

Fees

Withdrawal

Fees Token

Listing

Fees

Token

Listing

Fees Staking

Staking Yield Farming

Yield Farming Subscription &

Membership Plans

Subscription &

Membership Plans

Looking to Develop a Cryptocurrency Exchange Software?

If you are searching best crypto exchange development company then your search ends here. Unlock the potential of our experts with just a click!

Business Models

Explore the diverse business models that we offer to develop a crypto exchange according to your vision, market goals, and operational needs.

Build a fully tailored crypto exchange from scratch according to your business goals, features, and branding.

Launch quickly with our ready-made and customizable crypto exchange solution for fast deployment.

Get a dedicated team of crypto exchange experts to work on your project with complete flexibility and control.

How Much Does it Cost to Create a Crypto Exchange Software?

The cost of building a crypto exchange platform can vary widely depending on several factors. Here's an estimate of the cost breakdown for different cryptocurrency exchange platforms:

Centralized Exchange

The cost required to build a centralized cryptocurrency exchange platform ranges between USD 20,000 and USD 80,000. Costs may increase based on performance needs, user load, and security features.

Decentralized Exchange

Developing a decentralized crypto exchange may cost between USD 20,000 and USD 65,000. The budget varies depending on smart contract complexity, blockchain integration, and user experience customization.

P2P Exchange

The estimated cost to create a peer-to-peer cryptocurrency exchange is between USD 15,000 and USD 45,000. This varies with features such as escrow systems, dispute handling, and KYC integrations.

Hybrid Exchange

A hybrid exchange platform may require a capital investment between USD 30,000 and USD 125,000. This depends on the desired balance between centralized speed and decentralized security protocols.

White-Label Solution

White-label crypto exchange solutions cost between USD 15,000 and USD 30,000. These are pre-built platforms that can be tailored to business needs, which reduces time and development expenses.

Our Crypto Exchange Development Process & Timeline

At Technoloader, we follow an agile crypto exchange development process that involves several key steps to ensure security and reliability. Have a look at how we approach it!

Crypto Exchange Development: Tech Stacks

Technoloader builds crypto exchanges on a modern and scalable tech foundation that ensures smooth trading, efficient backend processing, and robust security. With encrypted transactions, multi-layer protection, and real-time monitoring, our platforms deliver reliability and trust. Have a look at what powers our crypto exchanges!

Back-End & API Frameworks :

Node.js

Node.js

Java

Java

Go

Go

NestJS

NestJS

FastAPI

FastAPI

Frameworks:

Express.js

Express.js

Django

Django

WebSocket:

Socket.io

Socket.io

Databases:

PostgreSQL

PostgreSQL

MySQL

MySQL

MongoDB

MongoDB

Redis

Redis

AWS RDS

AWS RDS

Front-End Technologies

React

React

Redux Toolkit

Redux Toolkit

Tailwind

Tailwind

Bootstrap

Bootstrap

Next.js

Next.js

Web3.js

Web3.js

Typescript

Typescript

Message queue:

Apache Kafka

Apache Kafka

Redis Streams

Redis Streams

RabbitMQ

RabbitMQ

KYC:

Digitap

Digitap

Sumsub

Sumsub

Cloud / DevOps:

AWS

AWS

Docker

Docker

Nginx

Nginx

GitHub Actions

GitHub Actions

BitBucket

BitBucket

CI/CD Piplines

CI/CD Piplines

GCP

GCP

DigitalOcen

DigitalOcen

Apache2

Apache2

Security:

JWT

JWT

Bcrypt

Bcrypt

2FA

2FA

CORS

CORS

SSL/TLS Encryption

SSL/TLS Encryption

Libraries/SDKs:

Web3.js

Web3.js

BitcoinJS

BitcoinJS

Binance Chain SDK

Binance Chain SDK

Etherjs

Etherjs

wagmi

wagmi

Supported Chains:

Ethereum

Ethereum

Tron

Tron

Polygon

Polygon

Solana

Solana

Avalanche

Avalanche

SUI

SUI

TON

TON

Cardano

Cardano

Astar

Astar

Arbitrum

Arbitrum

Polkadot

Polkadot

Why Choose us as your Crypto Exchange Development Company?

Partnering with Technoloader allows you to have a team of experienced experts deliver top-notch solutions. Let’s take a look at why you should choose us as your cryptocurrency exchange development company!

Experienced Team

We have a team of industry experts with a strong track record of developing secure and scalable cryptocurrency exchanges tailored to your needs. They can even handle the most complex projects effortlessly and produce the desired results.

Customized Solutions

We understand that each business has distinctive needs and preferences; thus, we offer tailored solutions to our partners that can be designed to fit your unique business requirements, with scalable architectures that grow effortlessly.

Adherence to Standards

By leveraging our deep expertise in exchange development standards, you can seamlessly navigate complex global regulations with confidence. Our experts have specialized knowledge in integrating KYC and AML practices, ensuring both legal and operational integrity.

Robust Security Measures

Our cryptocurrency exchange development process prioritizes top-notch security. We do so by employing advanced encryption, multi-signature wallets, and rigorous protocols, which help safeguard your crypto exchange platform against potential cyber threats and fraud.

Quick Launch Time

We streamline the development process to ensure a swift launch, allowing you to enter the market faster and capitalize on emerging opportunities with minimal delay. This approach will give you a competitive edge and maximize your potential for success.

Full-Spectrum Support

From initial consultation and development to in-depth testing and ongoing maintenance, we provide complete support. Our goal is to ensure the success and long-term viability of your exchange, optimizing its performance and reliability throughout its lifecycle.

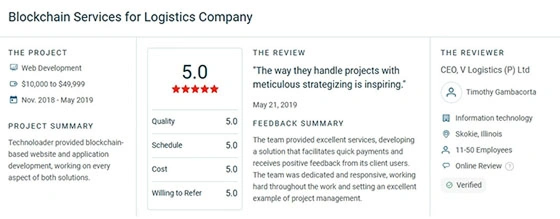

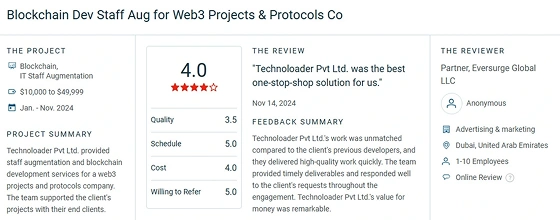

Partner with a Trusted Crypto Exchange Development Company

We’re a leading name in crypto exchange software development, recognized for delivering scalable and secure platforms. Our journey has been marked by excellence, innovation, and a series of industry recognitions that reflect our commitment to quality.

Frequently Asked Questions

The right crypto exchange model depends on your business needs. It includes:

Centralized is ideal for control and liquidity. Decentralized offers privacy and transparency. Hybrid blends both.To choose one, you need to evaluate user experience, compliance needs, and your target market.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com