Decentralized Exchange Development Company

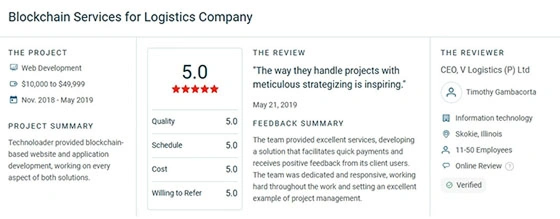

Technoloader is a reliable DEX (Decentralized Exchange) development company helping businesses and startups build secure, feature-rich, and scalable DEX platforms. Our DEX development services are meant to make complex blockchain processes easier and help you build a profitable and seamless trading ecosystem with confidence.

Are you planning to launch your own decentralized exchange? Partner with us and take your DEX project from idea to execution with trust!

8+ Years

Experience in Blockchain

50+%

DEXs Shipped

$2B+

TVL Secured

80%

Blockchain Expert

DEX Development Company: Turning Big Ideas Into DEX Reality

Still think CEXs are the only way to trade crypto? If yes, then you must know that time has changed! In today's time, DEXs are becoming the primary choice for traders prioritizing control, privacy, and reliability.

Platforms like PancakeSwap and Uniswap are already showing what the future of DEX can look like, and there's no reason you can't build one of your own.

That's where Technoloader, a leading decentralized exchange development company, can bring your DEX vision to real life. Whether you're starting a new platform or upgrading one you already have, we handle everything. Our professionals further help you with smart contracts, liquidity pools, and wallet integration, ensuring a smooth, seamless user experience.

Since the crypto space is moving fast, let's build something that keeps you ahead in the game!

Our Top-Notch Decentralized Exchange Development Services

We provide end-to-end decentralized exchange development services that are specifically catered to your needs. From backend architecture to user interface design, our developers handle everything. Here are the major highlights!

DeFi Exchange Platform Development Consulting

We assist you through every step of building a DEX, helping you choose the right technology, features, and architecture. Our experts further ensure your exchange is secure, scalable, and aligned with your business objectives, saving you time and costly mistakes.

Fair Launch Mechanics

We create transparent, community-driven token launch systems that prevent manipulation while ensuring equal access for all participants. Our fair launch frameworks increase trust, enable organic price discovery, and level the playing field for early supporters and investors.

Custom Decentralized Exchange App Development

Based on your specific desires, features, and branding, our specialists also offer customized DEX applications. From design to deployment, we build smooth, secure, high-performance trading experiences that work seamlessly both on the web and on mobile.

White-Label Decentralized Exchange Software

We provide ready-to-launch DEX software that can be quickly customized with your branding, features, and token support. We also help you enter the market faster while reducing development time and cost, without compromising performance or security.

DEX Protocol Forking

We leverage proven, robust DEX protocols to create your own customized version. This ensures you a strong starting point with reliable code while allowing endless modifications to match your goals.

Gas Optimization

We utilize smart contracts to reduce transaction costs and improve overall network efficiency. By minimizing gas usage, we often help users trade more affordably and increase your platform's competitiveness in the blockchain ecosystem.

Cross-Chain Bridging

We build secure and seamless cross-chain bridges, allowing individuals to transfer assets between different blockchains. This expands your DEX's reach, boosts liquidity, and gives trades more options across multiple ecosystems.

Subgraph & Data Indexing

By using tools like The Graph to display real-time trading, liquidity, and token information, we create fast, accurate data indexing solutions. This guarantees your decentralized experience has smooth analytics, quick data fetching, and reliable on-chain insights for users.

Custom AMM Logic

Our professionals design and implement unique Automated Market Maker algorithms tailored to your platform's needs. Whether you want stable pools, dynamic fees, or new pricing models, we develop AMM logic that enhances trading efficiency, liquidity, and user experience.

Security Features of Decentralized Exchange

At Technoloader, security is not just a common requirement; it's a vital need! So, as the primary decentralized exchange development company, we built DEX with safety and reliability at its core. Here are the core features we integrate!

MEV Protection

Smart Contract Auditing

Multi-Signature Vaults

Advanced Data Encryption

Application Firewall Protection

Anti-DDoS

Our End-to-End Decentralized Exchange Development Process

As a trusted decentralized exchange development company, Technoloder builds a DEX platform not just by writing code, but also by following essential proven processes. Let's look into this:

Our Decentralized Exchange Development Technology Stack

Core Protocol & Smart Contracts

Frontend & Integration

Infrastructure & DevOps

Engagement Models

Time & Material

Best for projects with evolving requirements and undefined scope.- Pay per hour/resource

- Weekly sprints & reporting

- Scale team up/down flexibly

- Direct access to developers

Dedicated Team

Your own extended engineering team. Best for long-term product development.- Full-time senior engineers

- Project Manager included

- Seamless workflow integration

- Retainer-based pricing

Fixed Cost

Ideal for MVPs and projects with well-documented specifications.- Defined deliverables & timeline

- Milestone-based payments

- No budget overruns

- Clear scope of work

Frequently Asked Questions

The time to build a DEX crypto exchange depends on factors like complexity, features, team expertise, and testing requirements. Basically, development can range from 2 to 4 months, varying depending on the planning, development, testing, and deployment phases.

The cost of developing a DEX varies widely based on methodology, blockchain network integration, complexity of the project, and the professional team. However, a reliable decentralized exchange development company like Technoloader might provide an exact estimation of costs.

In standard DEXs, we minimize IL by featuring a constant product formula. We usually integrate IL Protection programs where the protocol pays for losses with governance tokens or implement Oracle-guided pricing to minimize arbitrage opportunities that can cause Impermanent Loss.

To protect the DEX from front-running attacks, we prioritize setting a minimum output amount based on the user's slippage tolerance. For advanced protection, we also integrate Flashbots RPC or private transaction relays to bypass the public mempool entirely.

In the DEX, Instant Liquidity enables automated blockchain routines to withdraw tokens from the pool and use them for operations like arbitrage before settling the balance. However, as the equivalent value is returned within the same atomic transaction, the operation succeeds, and the entire transaction reverts as if it never happened.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com

Connect

on Whatsapp

Connect

on Whatsapp