Crowdfunding is a concept that originated back in the 18th century but it has got its due credit recently. With blockchain-based concepts like ICO and IEO, it has become very easy to approach the investors and raise funds. Right now, there is a surge in the market about these crowdfunding instruments and it is also the right time to utilize to establish your business.

Websites like Kickstarter have got hugely popular and they have doled out opportunities to entrepreneurs like never before. They have not only given chances to small-time business aspirants but also to big players to spread their wings into different domains. In particular, crowdfunding in real estate got a major boost lately and it would continue to grow. Its net worth is estimated to reach $300 billion by 2025 according to Forbes business magazine.

However, there are quite a few things that you need to take into account before kickstarting your own crowdfunding platform. Things like payment and verification have to be seriously considered, and they have to be implemented with high-end security.

Want to build Crowdfunding Platfrom ? Call / whatsapp : +91 7014607737 | Telegram : @vipinshar

What all would we cover in this platform?

- Overview of crowdfunding platforms

- Crowdfunding-oriented business models

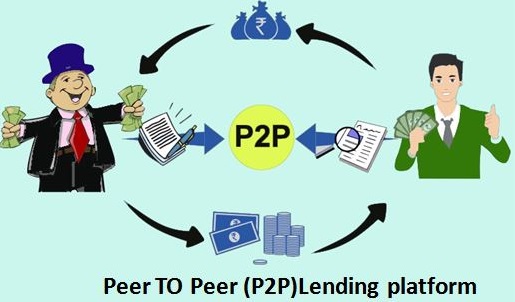

- P2P lending mechanism

- Practices followed in P2P platforms

- Choosing an appropriate payment method

- Customized or off-the-rack solution

Overview of Crowdfunding Platforms

There are various platforms available for crowdfunding now and each one of them offers something different to their clients.

Lately, the method of crowdfunding was introduced into many domains and as a result, we have a melange of blockchain-based projects from different industries.

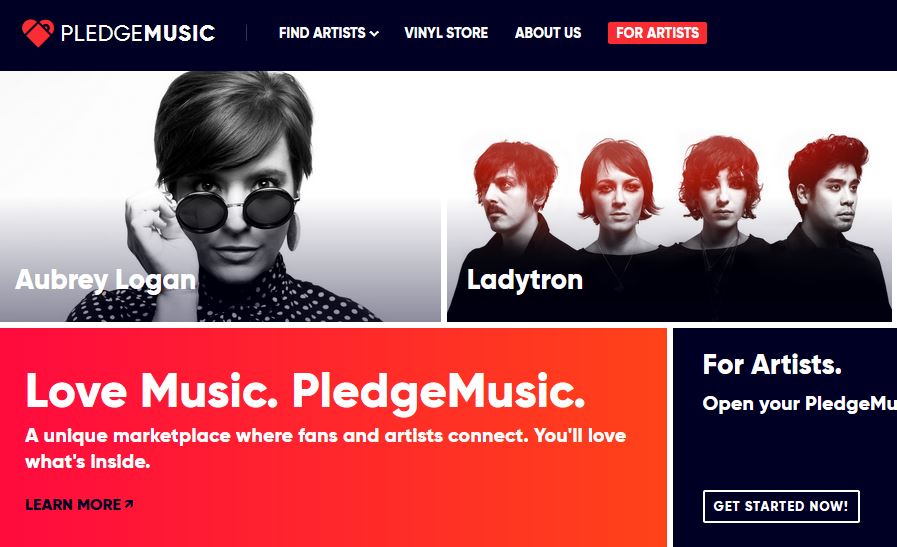

Music & Art

Through this platform, they can reach fans directly and receive funds. And this is not the only project that focuses on encouraging artists. PledgeMusic is another such platform that has introduced the concept of pre-ordering.

Using this mechanism, listeners can directly order the kind of music they want from the artists they like.

Agriculture

Agriculture has been a very complex domain which is infested with middlemen. AgFunder is a project that is working on bridging the gap between accredited investors and farmers. This platforms brings forward a unique concept which helps all types of borrowers to pay their debts directly to the investors.

It saves a significant amount of commission that had been siphoned off by the intermediaries. It is also very helpful in the projects where government distributes funds to the farmers but a large share is again taken by the middlemen.

Real Estate

Crowdfunding in this particular domain is booming and it is being used by a large number of service providers and owners as well. PeerStreet is an innovative project that offers short-term loans and it helps investors maintain more liquidity in their accounts. These loans can be paid within the period of 6 to 24 months with considerable grace period as well.

RealCrowd is another project which brings accredited investors into retail and real estate with better opportunities to grow. It offers them a limit of $200,000 with more extension and leniency for payments. It has also gathered a significant number of investors in a short time in the United States and Europe.

Space Exploration

As mentioned before, crowdfunding is finding its place in different industries and space isn’t out of its reach. However, crowdfunding for space exploration projects has to be conducted at a corporate level.

Industries, engineers, scientists, and private investors have to come together for making such projects successful.

A few projects have already been launched for Mars Colony, Orbital Glider, and Moon Exploration. Indiegogo has already raised about $314,000 out of its target amount of $400,00 for Mars Settlement campaign.

Another project called OrbitMuse offers a range of projects such as robotics, astrobiology, manned missions, telecommunications, asteroid mining, drones, and remote sensing.

Crowdfunding-oriented business models

It is very important to figure out which business model you are going to adopt for your crowdfunding campaign. That would decide how you would make profits and support your venture. Currently, you have a few options out of which you can make a choice:

- Royalty-based

- Peer-to-peer (P2P) lending

- Hybrid-based

- Equity-based

- Donation-based

So far, P2P lending has been the most popular and widely-used crowdfunding model. It has been adopted by many industries because it helps the project owner receive funds directly from the investors without any intervention of the middlemen. According to Massolution, a prominent P2P crowdfunding website, its fundraising volume reached $25 billion by 2015 and still growing.

P2P lending mechanism

The reason for the phenomenal success of P2P lending platforms is that it gives benefits to lenders and borrowers both in the same volume. Borrowers can directly approach the lenders without getting interrupted and the later, on the other hand, can secure bigger opportunities through a rising business. It rules any possibility of getting cheated as both the parties interact with each other and come to terms with conditions without putting their assets on stake.

However, the platform has a sophisticated mechanism for assessing risks, credit rating, and interest rates. The repayments are also carried out through the platform and escrows are also involved in the entire process of payments. Often, the third party is involved in performing credit history checks and ascertaining the credit rating of the borrower.

In the very beginning, a borrower pays the registration fee which is used in processing the loan with an interest rate of 1% to 5%. And that’s how the P2P lending platforms make their own earning.

Practices followed in P2P platforms

The fundamental practice followed by most of the platforms is the implementation of the registration fee for borrowers and lenders both. The registration form could be either bi-partite for both the parties or they could be a single one which has to be filled by both of them.

Borrowers have to be elaborate enough to explain their offerings alongwith the additional details regarding funding goals, repayments, opening/closing dates, and transactions.

The platform should allow the investors to view the offerings and to manage investments and wallets. It should enable them to add funds to their wallets and perform cancellation or withdrawal. They should also get updates about how the performance of projects they have invested in.

A robust mechanism should work perfectly to make all these things happen. The first thing that needs to be checked is investor’s credibility and it can be done manually or automatically as well. The manual approach takes some time and manpower too.

Also, there are a number of services that you integrate into the system. Unless you beef up the mechanism with secure and user-friendly features, it cannot attract many clients. It is also very important to safeguard the information of customers and protect them from fraud.

Here’s a list of features that you must integrate with the platform for delivering credible services:

Account Tracking

- KYC and AML

- Support of Multiple Accounts

- FAQs and Support Page

- Data Security

- Credit Score Management

- ID Verification

- Financial Statistics and Reports

- Transaction Management

- Personal Finance Management

- Admin Back Office

- Technical aspects to consider:

- Mobile Optimization

- Hosting Providers

- Web Servers

- Traffic

- SSL Certificates

- Payment Methods

- Traffic

- Audio/Video Media

Don’t just aim for delivering high-end security, but also make the platform user-friendly. You need to ensure that borrowers and investors understand each other with a clear structure and a simple interface. The website should be easy to navigate and it should make everything clear to the visitors.

Choosing an appropriate payment method

The P2P structures do not come with in-built payments systems. Therefore, you need to integrate a third-party solution which could process payments easily and safely. You need to choose a service provider who could make the payments inclusive. You need to focus on involving as many methods of payment as possible and making them secure at the same time.

The basic features that you require for a crowdfunding website are the adjustment of interest rates, online wallets, scheduling of repayments and easier returns of funds to investors.

You may get stuck to the most familiar options such as PayPal or Stripe but when it comes to finding payment options, the sky is the limit. There are many more alternatives that you can think about such as Reyker, MangoPay, GCEN or LemonWay. These are some payment options which are specifically crafted for crowdfunding operations.

These platforms allow you to hold funds, collect payments, make refunds and collect payments in a secure manner. Notably, the UK citizens are eligible for tax-free interest on peer-to-peer investments of up to EUR20,000 on holding an individual savings account.

Customized or off-the-rack solution

Now that you know about the basics of P2P lending platforms, you can think about the thing and that is the cost. The cost is determined on the type of website you want to adopt.

There are two options to choose from and both of them have their own pros and cons. Depending on your requirements and specifications, you should choose the platform.

To develop a customized crowdfunding website, you need plenty of time first of all. Suppose that you manage to gather the entire team in time which includes developers, business analysts, designers, QA specialists, and projects, it would still take you a very long time to create a perfect website which meets all your needs.

But there are advantages of this approach which cannot go unnoticed. You have total control over every single aspect of operations and you can make changes whenever you want.There would be no technical hindrance as the developers and designers will create the platform as you instruct them.

However, if you are unable or unwilling to form a team on your own and spearhead the operations yourself, then you obviously go for the second option which is to get a ready-made platform for crowdfunding. These platforms are designed as per the common set of requirements and specifications sought by most of the businesses. The platforms are thoroughly tested and they are structured to execute all the tasks you need to carry in a crowdfunding campaign.

But that doesn’t mean that there is no room for customizations at all. Off-the-rack systems allow you to introduce little changes if you want.

Upshot

Whichever platform you go for, you cannot rule out the legal assistance before kickstarting your own crowdfunding website. Fund-raising is now done with security tokens as well which are secured against assets. As a service provider, you cannot take any risks and leave a loophole which could be used by someone else. You need to be extensive in your approach and understand all the other collateral aspects.

You can get an appropriate platform which could be used far-reaching crowdfunding campaigns. All you need is a crowdfunding platform development company which could provide precisely what you are looking for. For making your platform successful, you need to ensure that it could be adopted by maximum businesses. And that is possible when you have an expert by your side.

Want to build Crowdfunding Platfrom ? Call / whatsapp : +91 7014607737 | Telegram : @vipinshar