As the cryptocurrency world is growing rapidly, the need for fast and trustworthy crypto exchange platforms is rising altogether. And this is where centralized crypto exchanges come in. Centralized crypto exchanges, for sure, are one of the most popular types of crypto exchanges, and for all good reasons.

This blog will be your comprehensive guide to centralized cryptocurrency exchange development. We’ll be discussing everything from the key features to the step-by-step development process of centralized cryptocurrency exchange.

So, without further ado, let’s get started!

Table of Contents [hide]

- 1 Understanding Centralized Cryptocurrency Exchanges (CEXs)

- 2 Benefits of Centralized Crypto Exchanges

- 3 Key Features of Centralized Crypto Exchanges

- 4 Planning and Strategy for Centralized Crypto Exchange Development

- 5 Technical Development of a Centralized Cryptocurrency Exchange

- 6 Security Measures in Centralized Exchange Development

- 7 Launch and Deployment of a Centralized Cryptocurrency Exchange

- 8 Post-Launch Considerations and Benefits of Centralized Crypto Exchanges

- 9 Conclusion

Understanding Centralized Cryptocurrency Exchanges (CEXs)

Centralized crypto exchanges more commonly known as CEXs are crypto trading platforms where the users can perform transactions (i.e. buy or sell) of their digital asset through an intermediary. This intermediary or centralized authority facilitates transactions, manipulates order books, and ensures liquidity.

Contrary to decentralized crypto exchanges, where crypto trading between two users is completely direct without the need for any centralized authority, CEXs require the user to deposit their funds in the exchange wallet.

Due to the centralized nature of CEXs, users can trade faster than they can with decentralized exchanges. However, with increased transactions and high liquidity, users also have to bear the risk of the security of the exchange.

Security: Despite the fact that centralized exchange platforms follow robust security measures such as encryption, multifactor authentication, and cold storage to protect users’ funds, the risk of being a prime target for hackers is high.

User Control: The intermediary authority in CEXs is responsible for the management and protection of user’s funds as users don’t have complete control over them. On the other hand, DEXs give their users complete authority over private keys and assets.

Read More: A Comprehensive Guide to Hybrid Crypto Exchange Development

Liquidity: The centralized nature of CEXs benefits from high liquidity. As centralized crypto exchanges are quite popular and have a large base of users, placing large orders quickly and at a good cost becomes significantly easy.

Benefits of Centralized Crypto Exchanges

Centralized crypto exchange platforms offer a plethora of benefits to their users. To name a few:

- Ease-of-Use

- Dedicated Customer Support

- Advanced Trading Features

- High Liquidity

- Fiat-to-Crypto Trading Pairs

- Security Measures

- Order Book Management

- Access to a Wide Range of Cryptocurrencies

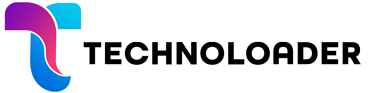

Key Features of Centralized Crypto Exchanges

Here are the key features of a centralized crypto exchange –

Centralized Order Matching System

In order to automate order matching and sales, CEXs use a centralized order matching system. Centralized order matching helps in operating the trades quickly and accurately. Consequently, trades operate at higher margins and more stable prices.

User Authentication and Account Management

CEX platforms follow a robust verification process at the time of account creation. Hence, crucial user authentication methods such as email authentication, two-factor authentication (2FA), and secure password protection for user accounts are done.

Wallet and Custody Services

Centralized crypto exchanges provide users with digital wallets where users can store their cryptocurrency. These wallets are also managed by the crypto exchange and hence, have vital security measures.

KYC/AML Compliance

Legal regulations such as Know-Your-Customer (KYC) and Anti-Money Laundering are important for any crypto exchange. Centralized exchanges thoroughly comply with these regulations in order to prevent illegal activities.

Advanced Trading Options

Centralized crypto exchanges are popularly known for providing advanced trading options such as margin trading, futures, and stop-loss orders. As a result, users are provided with an easy and advanced trading experience.

Planning and Strategy for Centralized Crypto Exchange Development

Let’s get started with a centralized crypto exchange development process –

Market Research and Analysis

Strategizing your centralized crypto exchange development starts with conducting thorough market research. This significantly helps in understanding the current state of the crypto market. Make sure you comprehensively analyze market trends, user demands, and preferences.

Identifying Target Audience

It is also crucial to deeply understand your target audience. Know what they seek, how they interact with the existing platforms, how is their trading experience, and various other demographics. This consequently helps in creating a centralized crypto exchange platform that is feature-rich and meets the needs of the users.

Analyzing Competitors

Studying your competitors is also a vital part of strategizing your decentralized crypto exchange development. Make sure you completely understand what they are offering in the market, their market position, and most importantly, what they are lacking. This analysis will significantly help you to bridge the market gap.

Defining Unique Selling Propositions (USPs)

Another important thing to make your centralized crypto exchange a success is defining clear USPs that make your platform better than the rest. Make sure your platform’s USPs address the pain points of your target audience and hence, ensure, they choose your platform for trading crypto. Here are a few USPs that you can work around – lower trading fees, better security measures, support for different cryptocurrencies, or new trading tools.

Regulatory Considerations and Compliance

Complying with the legal regulations related to crypto trading platforms is very important. Therefore, ensure proper research around legal requirements is done. Kindly note that law and regulations around crypto trading platforms may differ as per the area you plan to operate your exchange in.

Read More: A Comprehensive Guide to Decentralized Crypto Exchange Development (DEXs)

Verification procedures such as KYC (Know Your Customer) and AML (Anti-Money Laundering) must be carefully completed to avoid any legal problems in the future. Following all the legal regulations consequently helps in gaining the trust of the users and building a wide user base.

Technical Development of a Centralized Cryptocurrency Exchange

Choosing the Right Technology Stack: Selecting the appropriate technology stack is crucial for building a robust and scalable centralized cryptocurrency exchange (CEX). The choice of technologies affects the exchange’s performance, security, and user experience.

Backend Technologies

Some of the most popular choices for backend development are Node.js and Python. If you seek high performance and scalability for your centralized crypto exchange to process rea;-time data and concurrent user requests, choosing Node.js is a good option. On the other hand, simplicity and extensive libraries are key points of Python. Python is quite helpful in implementing complex algorithms and security systems.

Frontend Technologies

For the front-end tech, React and Angular are the top choices. Front-end development with React significantly helps enhance the user experience by providing real-time updates and seamless integration with its functional interface. Angular is more proficient in building scalable and maintainable applications through its strong framework.

Database Management

In order to handle and store large volumes of transaction data, an effective database is quite important. Two popular choices for database management tools are PostgreSQL and MongoDB. PostgreSQL is quite popular for its reliability and data integrity. Meanwhile, MongoDB is preferred for operating diverse data types as it offers great flexibility and scalability.

Core Components of CEX Development

Trading Engine: The trading engine helps in buying and selling orders, processing transactions, and also ensures market liquidity. All in all, it works as the heart of the CEX. In order to handle a large number of transactions per second, it is highly important for a trading engine to have low latency and high performance.

User Management System: The user management system is responsible for managing user accounts, authentication, and authorization. Moreover, UMS’s key features such as user registration, KYC verification, login, and password management are quite helpful in ensuring data safety.

Wallet Integration: As all the transactions in a centralized exchange will be done through an intermediary, the need for integration of secure crypto wallets is necessary. Moreover, these crypto wallets should support multiple cryptocurrencies and provide secure storage solutions, such as hot and cold wallets.

Payment Gateway Integration: Payment gateway integration is essential in order to trade fiat currencies. Therefore, it should also support various payment gateways.

Ensuring Scalability and Performance: For maintaining the high performance of the centralized crypto exchange, it is quite important to implement scalable infrastructure, load-balancing tools, and strong database management.

Centralized Crypto Exchange Solutions and Third-Party Integrations

Liquidity Providers: Strong integration with liquidity providers is necessary in order to confirm sufficient liquidity in the exchange. This will allow users to trade fast and that too at competitive prices.

Market Makers: Partnering with market makers helps in maintaining market stability and liquidity. Market makers provide buy and sell orders, reducing the bid-ask spread and improving the overall trading experience.

Security Measures in Centralized Exchange Development

Here are some of the key security measures that must be taken –

Common Security Threats in CEXs

Hacking: As centralized crypto exchanges seamlessly hold large amounts of crypto funds, they are a prime target for hackers. Any vulnerability in the exchange can lead to cybercriminals breaching user funds.

Phishing: Phishing is a very big concern in the digital world. Phishing attacks seek to trick users into providing their login credentials or other sensitive information through fraudulent emails and web messages.

Implementing Robust Security Protocols

- Encryption: Using strong encryption techniques such as end-to-end encryption helps in protecting sensitive data during transmission and storage. As long as the data is encrypted, unauthorized parties will not be able to read the data.

- Multi-Signature Wallets: Multi-signature wallets, also known as multi-sig wallets, use multiple private keys to operate a transaction. Hence, an extra layer of protection gets added to the funds.

- Regular Security Audits: Conducting regular security audits helps identify and rectify vulnerabilities in the system. These audits should be performed by professional security experts to ensure unbiased assessments.

User Security Features

- Two-Factor Authentication (2FA): Two-factor authentication means adding another layer of security. This is done by asking users to provide two forms of authentication before logging into their accounts. This usually includes passwords and codes to their mobile device.

- Withdrawal Whitelists: Withdrawal whitelists refer to the withdrawal addresses given by the user. In case, the security of an account is compromised, funds will only be withdrawn to pre-approved addresses.

Launch and Deployment of a Centralized Cryptocurrency Exchange

Pre-launch Checklist: Ensure that all technical, security, and operational aspects are thoroughly checked before launching a centralized cryptocurrency exchange. Various parts such as the trade engine, user management system, wallet integration, and payment gateway should be intact. Ensure security measures are in place and properly tested, confirm compliance with regulatory requirements, and prepare all regulatory documentation.

Beta Testing: Perform a beta testing phase to identify any issues or bugs during development. Collect feedback on user experience, performance, and any issues encountered. Use this information to make necessary adjustments and corrections before the official launch.

User Feedback: Collect and analyze user feedback from the beta testing phase to better understand user needs and expectations. Address any concerns or suggestions to improve platform functionality, security, and overall user experience. This iterative process helps to fine-tune the changes to better meet market requirements.

Marketing Strategies for a Successful Launch

- Community Building: Create a strong community for your decentralized crypto exchange by connecting with potential users through forums, social media, and other online platforms. Moreover, incentives for early adopters create a sense of belonging and trust in the community.

- Social Media Campaigns: Use social media platforms like Twitter, Facebook, LinkedIn and Reddit to promote your crypto exchange. Share regular updates, educational content, and promotions to generate interest and engage users. Use targeted ads for specific demographics and potential users.

- Influencer Partnerships: Partnering with influencers in the cryptocurrency and blockchain space, you can use their reach and credibility to attract users. Influencers can help get your conversion in front of their followers, provide valuable exposure, and attract new users.

- Initial Coin Offerings (ICOs) or Token Sales for Funding: Consider launching an ICO or token sale to raise funds for your centralized crypto exchange. Not only does this generate significant capital but it also creates a community of investors who are both financially and emotionally invested in the success of your platform.

Post-Launch Considerations and Benefits of Centralized Crypto Exchanges

Ongoing Maintenance and Updates: Once a centralized cryptocurrency exchange is launched, ongoing maintenance and regular upgrades are required to ensure proper operation and security. This includes fixing bugs, adding new features, upgrading security systems, and improving performance. Continuous innovation helps keep the platform competitive and in line with user expectations.

Customer Support and User Engagement: Providing good customer support is essential to retain users and gain their trust. You can also use multiple support channels, such as live chat, email, and phone support to quickly address user questions and concerns. Interact with users through community forums, social media, and regular newsletters to keep them informed about the progress and updates of the change.

Monitoring and Compliance: Continuously monitor exchanges for any suspicious activity, security concerns, etc. Use real-time monitoring tools to make sure the platform’s integrity is maintained. Stay up-to-date with changes in crypto laws so that the exchange remains in compliance with all legal requirements to avoid penalties and maintain user trust.

Scaling the Platform: As the user base grows, the platform needs to be scaled to handle the increased traffic and workload. It is important to invest in scalable infrastructure, load balancing, and effective database management to ensure the platform can accommodate growth without compromising performance or security.

Conclusion

Coming to the end, we certainly hope that this complete guide to understanding centralized cryptocurrency exchanges will help you with all your doubts related to developing centralized crypto exchanges.

Ready to build your own centralized cryptocurrency exchange using the latest technology and expert guidance?

This is where Technoloader comes in!

Connect with Technoloader today and get your professional centralized cryptocurrency exchange development company with a team of experienced developers by your side. You’ll be all on your way to building your centralized Exchange!

Frequently Asked Questions

What is a Centralized Cryptocurrency Exchange (CEX)?

Ans – Centralized crypto exchanges more commonly known as CEXs are crypto trading platforms where the users can perform transactions (i.e. buy or sell) of their digital asset through an intermediary. This intermediary or centralized authority facilitates transactions, manipulates order books, and ensures liquidity.

How do Centralized Exchanges Differ From Decentralized Exchanges?

Ans – Contrary to decentralized crypto exchanges, where crypto trading between two users is completely direct without the need for any centralized authority, CEXs require the user to deposit their funds in the exchange wallet. Due to the centralized nature of CEXs, users can trade faster than they can with decentralized exchanges. However, with increased transactions and high liquidity, users also have to bear the risk of the security of the exchange.

What are the Main Benefits of Using a Centralized Crypto Exchange?

Ans – Centralized crypto exchange platforms offer a plethora of benefits to their users –

- Ease-of-Use

- Dedicated Customer Support

- Advanced Trading Features

- High Liquidity

- Fiat-to-Crypto Trading Pairs

- Security Measures

- Order Book Management

- Access to a Wide Range of Cryptocurrencies

What are the Essential Features of a Centralized Cryptocurrency Exchange?

Ans – Here are some of the key features of a centralized crypto exchange –

- Centralized Order Matching System

- User Authentication and Account Management

- Wallet and Custody Services

- KYC/AML Compliance

- Advanced Trading Options

What Security Measures are Important for Centralized Crypto Exchanges?

Ans – Here are some important security measures that must be followed to ensure a secure centralized crypto exchange –

- Encryption

- Multi-Signature Wallets:

- Regular Security Audits

- Two-Factor Authentication (2FA)

- Withdrawal Whitelists